Because money saved is money earned.

Let’s face it, this year has been a weird and surreal one for several reasons. Who would have thought at the beginning of the year that having “formal yoga pants” would be so important! A lot of us have had to change the way we work to incorporate homeschooling, working from home and flexible schedules. Many are struggling with a change in our circumstances – this might be losing your job, needing to take unpaid leave or a reduction in work available. So, how can we change our financial plans this year to see if we can save money?

Read more: 5 Ways To Financially Prepare To Be A Parent In Hong Kong

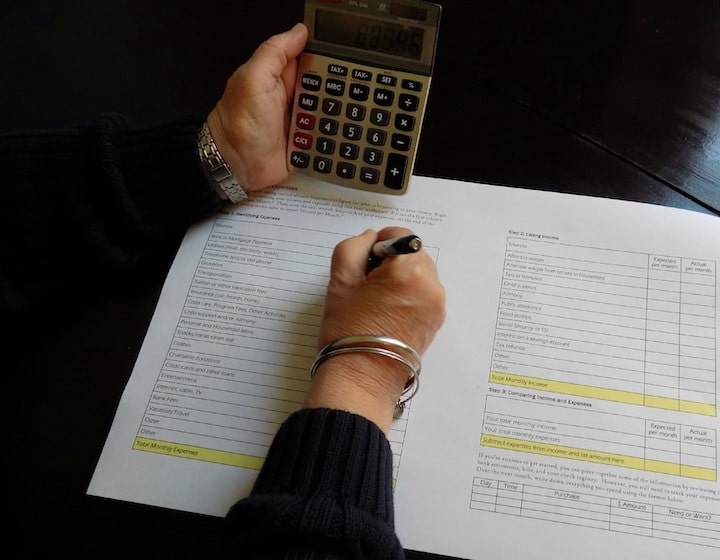

1. Weigh Incomings Vs Outgoings

Even before we can start making changes to our financial plans, we need to have a proper look at what our inflow and outflow of money is. Even if this has been something that you’ve been putting off for a long time, it is a great time to put it to the top of our to-do list.

The simplest thing to do is to draw a line down a piece of paper and put your incoming on one side and outgoings on the other. For households with at least one salary coming in, noting down the income is easy. For those who are self-employed, divorced, own rental properties etc., this can be slightly more complicated. Also, remember to include only bonuses that are guaranteed.

For the outgoings separate them into the ones that are essential (rent/mortgage, school fees, utilities, groceries, etc.) and those that are preferable (dinners out, delivery food, online impulse buys, etc.). Now that you know what your incomings vs outgoings are, you can start to make suitable changes to your financial plans.

Read more: Career Choices For Expats In Hong Kong: How To Get Back To Work

2. Determine Your Debts

For some of us, debts can make us feel like we are drowning. I have spoken to several clients over the years who happily pay huge fees for credit card debts without really ever examining it.

Make a list of all the credit cards, tax loans, mortgage debts and any other debts you have both in Hong Kong and globally. A good way to arrange the payments is in order of interest rate. A credit card debt will have an interest rate of 30 to 50% per year and needs to be paid back as priority in comparison to a tax loan or mortgage. In general, aim to pay back any debt with an interest rate above 10% as a priority.

3. Reassess Your Rental

For people living in Hong Kong, our greatest and most annoying expense is our rental. If you find that you are renting somewhere that is now an unmanageable expense, the impulse reaction could be that you need to move. Be careful with this. Work out how much your moving costs would be and what that relocation does to your family finances. There is no point moving to save a couple of thousand dollars a month if it will cost you that in transport or the moving cost will knock out your savings. If your rent is becoming an issue, it might be time to speak to your landlord to see if there is any wriggle room to reduce it.

When looking for a new flat, make a list of the non-negotiable things you need but keep an open mind. Do you really need a spare bedroom for the occasional visitor or would it make more sense to get them in a service apartment or hotel and save the money?

Read more: A Quick And Easy Guide To Relocating Within Hong Kong

4. Examine Your Entertainment

A simple way of saving money should be to stop going out – we have all had a chance to see how much this would save us in real life this year! While you are trying to change your financial plans, it’s a great time to have a look at your bills and work out how much cooking and drinking at home has saved you. Is it sustainable? Probably not, as we are all desperate to be out and about now but it might make you think again as to eating out several nights a week.

5. Travel Savings

I know that the fact that most of us are no longer planning holidays for this year is depressing. However, with the savings on plane tickets and hotels, there is a real chance to either add to our savings or reduce some debts. Most hotels in Hong Kong are desperate for business so there are some great deals available for staycations at the moment. The border to Macau should be opening soon and there are some wonderful resorts over there where you can get a couple of days away as a family if the idea of staying in your apartment any longer is driving you to distraction.

6. Be Flexible And Aware

It might be that you have your heart set on a big purchase or you were planning on saving a certain amount this year. Be flexible and nice to yourself – perhaps that isn’t possible at the moment so maybe you need to reassess your timeframe and cut yourself some slack.

On the other hand, keep abreast of the local news and make sure you don’t miss out on compensation and potential savings. For instance, sign up for the state-provided CuMask+, write to the school bus and canteen company to claim refunds (if applicable) and don’t lose out on money offered by the government to parents of school children and permanent residents (and residents on low incomes).

Read more: Expert Advice: How To Talk To Your Kids About Diseases

View All

View All

View All

View All

View All

View All

View All

View All